Financial forecasting is a critical process that helps businesses anticipate future revenues, expenses, and cash flow. Whether you’re a startup preparing for growth or an established company managing your finances, financial forecasting equips you to make informed decisions and prepare for uncertainty.

In this comprehensive guide, we’ll break down what financial forecasting is, why it’s essential, and walk you through 8 actionable steps to create a reliable financial forecast for your business.

What Is Financial Forecasting?

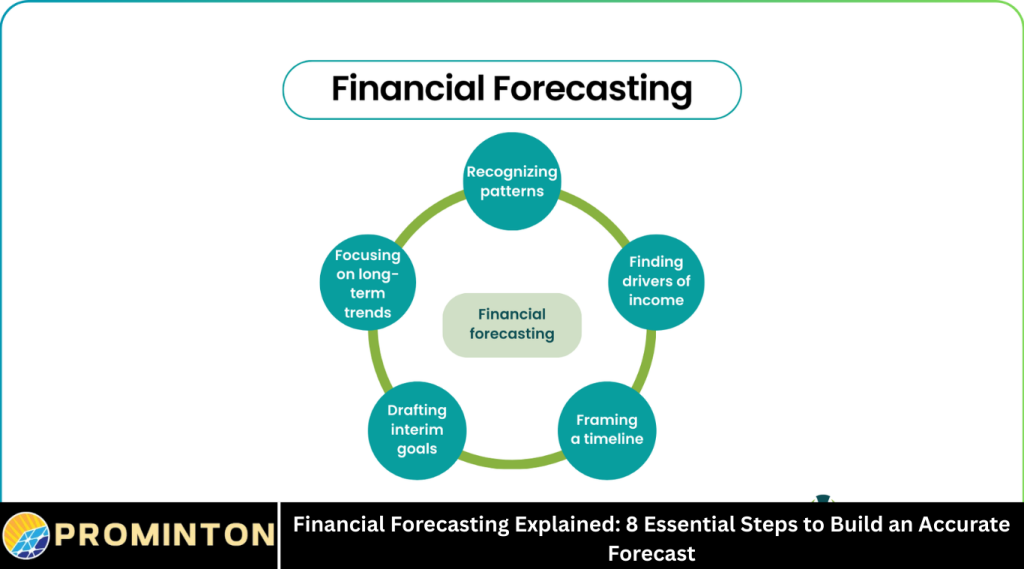

Financial forecasting is the process of estimating or predicting how a business will perform financially over a future period. It involves analyzing current and historical financial data to project future revenue, expenses, cash flow, and profitability.

There are two main types of financial forecasts:

- Short-term forecasting: Typically covers the next 12 months and focuses on cash flow, sales, and operational costs.

- Long-term forecasting: Covers 3–5 years (or more) and is used for strategic planning, investment decisions, and growth modeling.

Financial forecasts help answer questions like:

- Will we have enough cash to cover payroll next quarter?

- Can we afford to expand operations next year?

- What will our profits look like if sales increase by 20%?

Why Is Financial Forecasting Important?

Here are several reasons why financial forecasting is crucial:

Improved Decision-Making

Forecasts guide decisions related to budgeting, hiring, marketing, capital investment, and more.

Risk Management

By modeling different scenarios, forecasting helps businesses prepare for potential downturns or unexpected expenses.

Cash Flow Management

You can predict shortages or surpluses and manage working capital accordingly.

Investor and Stakeholder Confidence

Lenders, investors, and board members often require financial forecasts to assess the viability and direction of your business.

Strategic Planning

Forecasting supports long-term planning and goal setting by providing financial context to strategic decisions.

8 Essential Steps to Build an Accurate Financial Forecast

Creating a financial forecast may seem daunting, but following a structured process makes it manageable. Let’s walk through the eight key steps:

Define the Purpose and Time Frame of the Forecast

Before gathering numbers, determine the goal of your forecast:

- Are you projecting cash flow for the next quarter?

- Estimating profits for the next fiscal year?

- Creating a long-term model for investors?

Decide on the forecast period:

- Short-term (monthly/quarterly up to 1 year)

- Medium-term (1–3 years)

- Long-term (3–5 years+)

Pro tip: Align your forecast period with the planning cycle or decision-making window you’re focusing on.

Gather Historical Financial Data

To forecast the future, you must understand the past. Collect financial data from the last 1–3 years, including:

- Income statements (revenue, COGS, expenses)

- Balance sheets

- Cash flow statements

- Sales and marketing performance

- Seasonal trends or anomalies

Tip: If you’re a startup without historical data, use industry benchmarks, competitor insights, and market research.

Choose a Forecasting Method

There are two primary methods of financial forecasting:

Qualitative Forecasting

Used when historical data is limited (e.g., startups or new products). Relies on expert judgment, market research, and industry trends.

Quantitative Forecasting

Uses historical data and mathematical models to project future performance. Examples include:

- Time series analysis

- Regression analysis

- Moving averages

- Percentage-of-sales method

You may use a mix of both, depending on your data availability and goals.

Forecast Revenue

Revenue forecasting is the most important—and often the most difficult—part of the process.

Consider the following:

- Sales pipeline or backlog

- Growth rate assumptions (based on history, market trends, marketing efforts)

- New product launches or geographic expansions

- Seasonality and external factors (economic, political, etc.)

Example:

If your average monthly sales growth over the last 6 months is 5%, you might project next month’s revenue as:

Current month revenue × 1.05

But be cautious—overly optimistic forecasts can mislead planning.

Project Expenses

After forecasting revenue, estimate your operating and capital expenses.

Break expenses into fixed and variable:

- Fixed costs: Rent, salaries, insurance—do not change with sales volume.

- Variable costs: Marketing spend, production costs—change with activity level.

Also include:

- One-time costs (e.g., new equipment purchases)

- Cost of goods sold (COGS)

- Depreciation and amortization

- Taxes and interest

Tip: Use a percentage-of-revenue model for variable costs if you lack detailed expense tracking.

Estimate Cash Flow

Now that you’ve projected income and expenses, use this data to build a cash flow forecast.

- Begin with starting cash balance

- Add cash inflows (sales, loans, investments)

- Subtract cash outflows (operating, financing, investing costs)

A cash flow statement typically includes:

- Operating activities (daily business operations)

- Investing activities (asset purchases/sales)

- Financing activities (loans, equity)

This forecast helps ensure your business won’t run out of cash—even if you’re profitable on paper.

Build Forecasted Financial Statements

Use your revenue, expense, and cash flow projections to build the following:

- Pro forma income statement (projected profits/losses)

- Pro forma balance sheet (projected assets, liabilities, equity)

- Pro forma cash flow statement

These forward-looking statements give a comprehensive picture of your expected financial health.

Tools to use:

- Excel or Google Sheets (most common)

- Forecasting software like QuickBooks, Float, Planful, or Finmark

Monitor, Update, and Refine

Forecasting isn’t a one-time task. Business conditions change, so your forecast must evolve too.

- Review monthly or quarterly performance vs. forecast

- Adjust assumptions and projections based on actual data

- Identify gaps and trends (e.g., overestimated sales, underestimated costs)

Pro tip: Build “what-if” scenarios (best case, worst case, base case) to prepare for uncertainty.

Common Forecasting Mistakes to Avoid

- Overestimating sales growth

- Ignoring cash flow forecasting

- Failing to account for seasonality

- Not updating forecasts regularly

- Relying too heavily on gut feelings over data

Benefits of Financial Forecasting

- Strategic clarity for budgeting, hiring, and investments

- Confidence for lenders and investors

- Operational control through early warnings on cash or cost issues

- Competitive advantage via proactive planning

Financial Forecasting Tools (Optional Section)

Here are some tools that help automate or simplify financial forecasting:

- Microsoft Excel / Google Sheets – Customizable but manual

- QuickBooks + Fathom – Great for small businesses

- LivePlan – Business planning and forecasting for startups

- Float – Cash flow forecasting

- Planful, Jirav, or Finmark – For more advanced and scalable forecasting

Frequently Asked Questions

How often should I update my financial forecast?

At a minimum, review your forecast quarterly. In fast-changing industries or startups, monthly updates are recommended.

What’s the difference between budgeting and forecasting?

A budget is a fixed plan for spending and revenue, while a forecast is a dynamic projection that adapts to real data and changing assumptions.

Can small businesses benefit from financial forecasting?

Absolutely. Forecasting helps small businesses manage cash flow, avoid debt traps, and plan for sustainable growth.

What if I don’t have enough historical data?

Use market research, competitor analysis, industry benchmarks, and expert judgment to create assumption-based forecasts.

How accurate are financial forecasts?

Forecasts are estimates—not guarantees. Their accuracy improves with better data, realistic assumptions, and regular updates.

Should I build different forecast scenarios?

Yes. Scenario planning (best, base, worst case) helps you prepare for a range of outcomes and make more resilient plans.

Is there software to help with forecasting?

Yes, tools like QuickBooks, LivePlan, Float, and Planful can simplify and automate the forecasting process depending on your needs.

Conclusion

Financial forecasting is more than just a finance function—it’s a strategic tool that empowers smarter decision-making, resource allocation, and risk management. Whether you’re just starting out or managing a multi-million-dollar enterprise, learning to build accurate financial forecasts is key to success.

By following the 8 steps outlined in this guide—from defining your goals to building pro forma financials—you can create forecasts that guide your business toward growth, stability, and resilience.